In the four years prior to 2008, mortgage backed securities drove the hotel acquisition market. Though issuance of new CMBS in 2008 has been replaced by withered vines (less than 1/10th the issues in the first two quarters of 2008 compared to 2007, and 0 in the third), CMBS defaults have remained quite low. In the next couple years, however, we’ll be seeing just how those vintages from 5 years back have matured. Will they be Chateau Latour, or will an economy in recession turn them to vinegar?

While the bulk of CMBSs may be able to survive the recent credit collapse, those with underlying assets that are economically sensitive may have a more difficult time of it, as may be the case with hotels. Projections for 2009 revenue per available rooms (RevPAR, a key metric for hotels) are falling as the economy worsens. Smith Travel Research reports that RevPAR for October 2008 declined 7% from the same month a year ago. If we have a hotel market which stumbles through 2009, two important questions come to the fore. First, could lagging revenues cause trouble in satisfying debt obligations? And second, how will owners refinance when their existing CMBS loans come to term?

While many CMBSs are based on a mix of commercial property types, those that are heavily skewed towards hotels will warrant a watchful eye. One particular CMBS, the Bear Stearns 2006-BBA7, is composed exclusively of hotel properties, and dominated by hotels owned by Columbia Sussex – one of the largest owners of full-service hotels in the US. Columbia Sussex is owned by William Yung, whose gaming company, Tropicana Entertainment, filed for Chapter 11 protection earlier this year.

Columbia Sussex loans accounted for 79% of the 2006-BBA7’s original loan principal. $1.1 billion was borrowed to finance acquisition of a portfolio of 14 hotels from Wyndham in October 2005: $570 million in Senior Notes and $532 in Mezzanine Loans. The loan is renewable for a one-year extension in October 2009 before maturing in 2010.

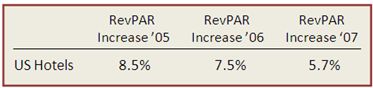

The real risk for this CMBS is Columbia Sussex’s performance. This portfolio of hotels has seen RevPAR go from $99.60 at issuance (the 12 months ending March 31, 2006) to $105.58 for year-to-date September 2008; occupancy went from 76% at time of issuance to 65% for year-to-date September 2008; and net cash flow declined 6% for YE2007 compared to issuance. These numbers show signs of struggle at a time when the hotel industry generally prospered nationwide.

Additionally, the portfolio’s second largest hotel, the 707-room Baltimore Sheraton, is in the midst of a labor dispute and boycott which has moved $2.142 million worth of hotel customers since November 2007. To make matters worse, a 757-room Hilton has opened in August 2008, adjacent to the convention center just a few blocks away.

Heading into a tighter hotel cycle with decreased occupancy and cash flow, this CMBS is one to watch amongst the slew of CMBSs that will require refinancing on the heels of the credit crisis and recession. The simultaneous need to refinance this portfolio’s mezzanine loans may compound efforts to refinance the first mortgage notes backing this CMBS.

According to Bloomberg News, there will be $185 billion worth of CMBSs coming due between 2010 and 2012 which originated in 2005-2007. “’Barring an economic/credit market miracle between now and then, the combination of falling property values, higher interest rates and tougher underwriting standards means numerous CMBS borrowers will have to come up with more money to refinance or default and return the property back to the lender…” according to a study cited by Bloomberg [10/3/08].

A full report on the risks associated with the Bear Stearns 2006-BBA7 CMBS, written by the UNITEHERE Research Department, is available at: Columbia Sussex Hotels: The Other Shoe?

Disclosure: The author is an employee of UNITE HERE, which represents approximately 100,000 non-gaming hotel workers in North America and represents workers at five non-gaming hotels owned and operated by Columbia Sussex, including two with active labor disputes.

source: seekingalpha.com

link to the original post:

http://seekingalpha.com/article/109364-a-window-on-hotel-cmbs-columbia-sussex

Fort Lauderdale Blog and Real Estate News

Rory Vanucchi

RoryVanucchi@gmail.com

http://waterfrontlife.blogspot.com

www.FortLauderdaleLiving.net