Working for the state's Office of the Condominium Ombudsman is dirty, sometimes even ''disgusting,'' work, say Bill and Susan Raphan, who supervise the Fort Lauderdale satellite office.

The tempers, the misunderstandings, the complaining -- the slapping, the threats and, at least once, the brandishing of a firearm.

''You would not believe some of the things we see,'' said Susan Raphan, who with her husband began working, first as volunteers, for the office soon after the Florida Legislature created it in 2004.

Despite the job's tribulations, the Raphans said they know that more than 1.5 million condo owners in Florida depend on them as a resource for understanding the rights and responsibilities that come with condo living. And they find satisfaction in helping people. Of the 16,000 phone calls the office got last year, Bill Raphan said roughly 90 percent were from Miami-Dade, Broward and Palm Beach counties and handled by Fort Lauderdale's staff of seven.

Their primary duties include acting as mediator between boards and angry owners, holding classes and seminars about condo law, and monitoring elections. But as the South Florida real estate market enters another year of soaring foreclosures and sinking home values, the Raphans expect a host of new problems they do not have the power to remedy -- condo associations entering bankruptcy, buildings closing and unit owners walking away from their long-held investments because they can't afford to carry the cost of empty units.

The reason: unpaid maintenance fees.

''It's a major problem,'' Bill Raphan said.

The Miami Herald sat down with Bill Raphan to discuss the issues facing condo dwellers.

Q: What are the biggest issues facing condo owners right now?

A: The condominium market, the problems in foreclosures, obviously, liens and delinquencies are a big problem right now. That's the biggest problem at this point, and it's up to the government to try to help us. There's not a lot our office can do. This is a national problem that is happening everywhere, but we have so many condominiums here. It's just more acute in this area.

Q: What kind of complaints have you been fielding?

A: People are complaining about foreclosures and their maintenance fees. I always explain it to them this way: Your condominium has to run like a business, and the business has to collect enough income to run the business, in this case, the association or the condominium itself. In order to maintain the property, you have to take in X amount of money. [The total amount needed] is like a big pie, and each person has a slice of that pie that they have to pay. So, for every person in your condo [who] is not paying, it means the slice of your pie gets bigger. In other words, if you're paying $100 a month and some people aren't paying, you might have to pay $110 or $120. You might have to pay $200, and there are places with 50 percent or more delinquencies. That means if you are paying $100 a month, you're going to pay $200 to keep that place going. People can't afford that nowadays. People are losing their jobs.

Q: What are condos doing to deal with the problem of budget shortages?

A: Some condominiums have actually eliminated their maintenance people, and they are cleaning up and doing things themselves. They've eliminated their landscapers and are cutting lawns. They've cut down as best they can on things they buy. The situation is very difficult. The people who are getting assessed that extra money are angry. They want something done, but there is not a lot that can be done.

Q: What about accusations that lenders are stalling foreclosures to avoid paying maintenance and association fees? Is there any truth to that

A: [Lenders] are not going to say they are stalling, but what condo owners are complaining about is a Florida statute that gives lenders a cap that says they don't have to pay more than six months of assessments or 1 percent of the value of the unit [before they foreclose on it. Then they must pay full association fees like other unit owners.] That's one of the things [Florida legislators] may be looking to change this year.

Q: Do you think there is a solution to getting lenders to pony up their share of maintenance fees?

A: It has to be legislative on any level, maybe even up to the federal government, who knows? It's a major thing. This is something that needs to be looked at on even a national level.

Q: What are the consequences of association-fee problems going unaddressed?

A: I know of several condominiums that are on the brink of people just walking out. They can't afford to maintain their units anymore. Their slice of the pie has become so big that they can't afford it. They are just packing up and leaving their largest investment because it doesn't pay for them to stay. You are going to be hearing about this very soon. This is going to be a real problem.

Q: So unit owners who've been in their condos for many years, who have equity in their condos and even may have paid off their mortgages, are still having to move because they can't afford maintenance fees?

A: Yes, and some condos can't take in even enough money to pay their water bills. They're shutting off the water. They're shutting off the electricity. They can't come up with the money because there are so many delinquencies. The few who are left can't come up with enough money to pay all the bills for everybody. It's sad.

Q: How do these problems affect sales in the buildings? I've heard it described as a ``death spiral.''

A: Sales are very poor because people don't have the money to buy, No. 1. And, they don't want to take over places with debt problems. Sales are very bad. Everything is very bad. Let's face it.

source:

http://www.miamiherald.com/living/home/story/834433-p2.html

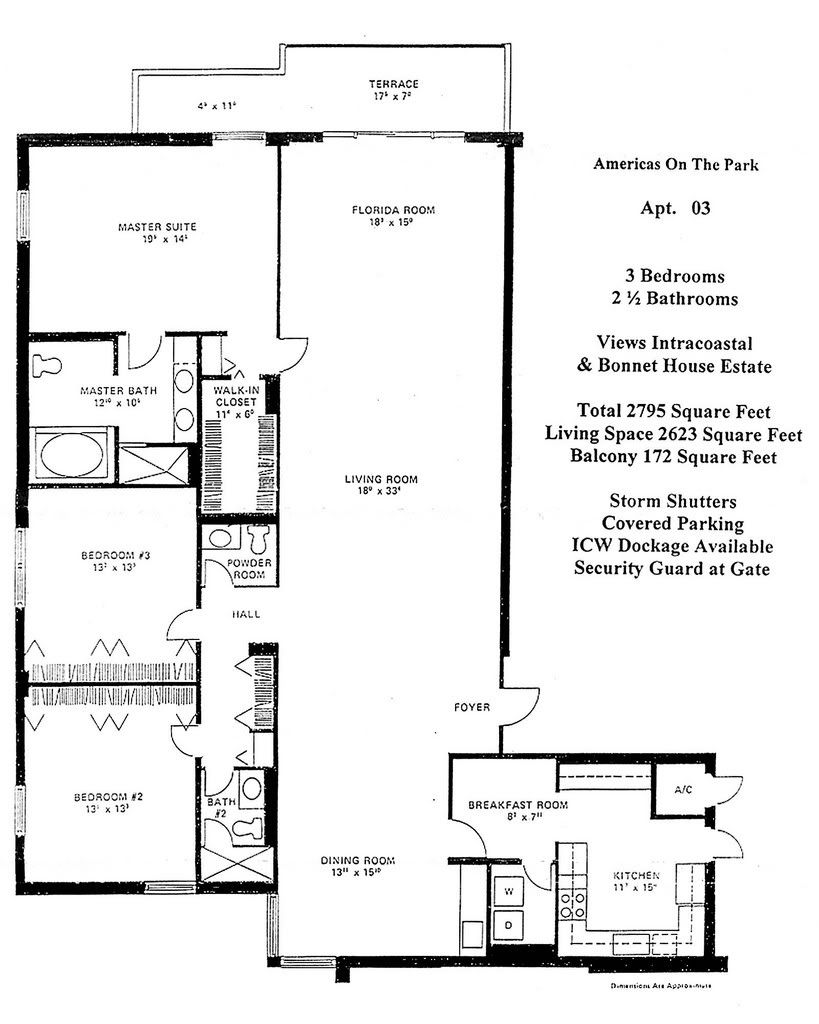

Americas on the Park Condominium

Americas on the Park Condominium