Though this title may be extreme to some readers, it is provocative on purpose. The dollar has appreciated 30 to 54 percent against most of the world's leading currencies over the last few months. Recently, 1.0 Euro was equal to 1.6 USD, now it is traded at 1.3USD. Similarly, 1.00 USD was equal to 1.03 Australian dollars; it currently is traded at 1.59 AUD.

The fact that something appears to be an extreme scenario does not necessarily make it unreasonable. In the economy there are cycles that canrepeat. A lack of balance is built gradually. When change happens gradually, people slowly become accustomed to it, soon accepting the new status quo without question.

Macro economic problems can not just be swept under the carpet, hoping that no one will notice. Over the last few months, many Americans are converting foreign currencies from countries such as Australia, New Zealand, Britain, Brazil and Turkey into US Dollars. The US dollars appreciated against the Euro 26%, the Australian dollar 54% and the British pound 30%. In the long term this will have to change; this article seeks to elaborate on the reasons why.

Why can't the American trade deficit continue to grow forever?

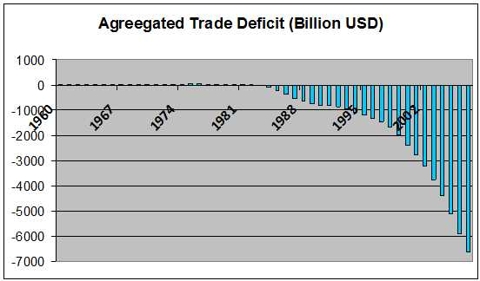

Until the 80's America had a surplus in its trade balance with most countries. Starting from the early 80's the trade balance began to change and the US economy shifted from a surplus to a deficit. In 2000, when the hi-tech bubble burst, federal banks tried to stimulate the economy and artificially encourageAmerican consumption by lowering interest rates and borrowing money from China, Europe and Japan to finance the trade balance deficit. The result is that American debt is now over 11 trillion dollars – almost 100% of the GDP of the US. This is similar to countries like Argentina and Turkey, significantly worse than most OECD countries.

In the following graph we can see how the American trade deficit was at almost zero in the 80's, jumping over the last 30 years to a significantly high proportion of the GDP.

Why is American trade deficit bad for the global economy?

This process of borrowing money from Europe, China and Japan is similar to that of an ordinary family in New York (say the Smith family) borrowing money from its bank over 30 years to buy property. Eventually their debt becomes more than the family's annual income. The Smiths will ultimately have to pay back the bank or it will begin foreclosure procedures.

This is exactly what will happen between the US and Europe, China & Japan; the Americans will have to pay it back. There is only one way to do so: stop lending money and start returning money by reducing imports and increasing exports.

Why is a weak USD necessary to decrease the American trade deficit?

American exports need to grow and imports must decline until the trade balance normalizes in order for debt to decrease.

Let's look at an American software exporter (The American Company) as it aims to sell its software in Europe, China and Japan. Let's say that average software is now being sold for 1,000 USD (6,800 RMB). If the dollar / RMB exchange rate depreciates to 4.00 the actual software price will still maintain 6,800 RMB price but in USD it will become 1,700 USD. This will generate The American Company higher revenues in USD, while costs remain the same. In addition, it will be able to compete better with Chinese and European Software developers, thus contributing to an increase in exports.

On the other hand, let's look at a toy manufacturer from Guangzhou, China that now receives 10USD for the average item it exports to the United States. Say that the cost is now 8USD (54 RMB). If the exchange rate is reduced to 4.00, the revenue per item drops to 40RMB, thus making it impossible to export to the US. The exporter will need to shift its focus to Europe, other markets in Asia and of course, Chinese consumers. Exporting toys to the US will no longer make sense, enabling local American toy producers to compete better in American local markets.

The final outcome would result in China importing more goods and services from US companies, while trying to divert some of their exports to countries where their currency is stronger. This would mean higher American exports, lower imports, thus lower debt. In this light, creating a weak dollar is the only remedy to treat the rising trade deficit.

Only time will tell, but by 2013 we could expect the following exchange rates:

Currency | Current exchange rate | Exchange rate (January 2008) | Change (last 3 months) | 2013 predictions | Expected change until 2013 |

RMB | 6.84 | 6.85 | 0% | 4 | -42% |

Yen | 115.00 | 96.00 | -17% | 65 | -32% |

AUD | 1.03 | 1.59 | 54% | 1 | -37% |

GBP | 0.48 | 0.62 | 30% | 0.4 | -35% |

Euro | 0.63 | 0.79 | 26% | 0.5 | -37% |

YTL | 1.16 | 1.68 | 45% | 1 | -41% |

This represents a USD average decline of 40% when viewed in comparison to a few major and emerging market currencies. If one is considering investing in American stock or bond markets, one must take this into consideration. In estimation, this trend would be gradual, but in reality foreign exchange market can react very quickly, thus affecting the overall the speed of this transition.

source: seekingalpha.com

link to the original post:

http://seekingalpha.com/article/109540-will-we-reach-4-rmb-per-u-s-dollar

Fort Lauderdale Blog and Real Estate News

Rory Vanucchi

RoryVanucchi@gmail.com

http://waterfrontlife.blogspot.com

www.FortLauderdaleLiving.net